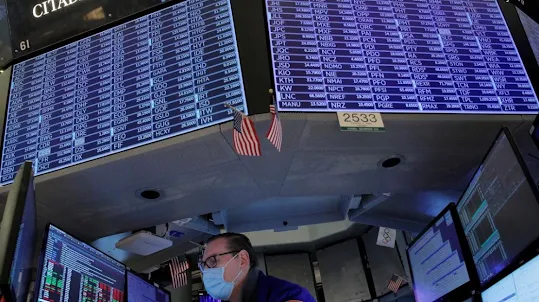

Wall Street was helpless in the last trading of the week. The three major indexes also fell after closing down more than 2.5%. This week, the three major indexes also returned to correction.

Friday (22/4), the Dow Jones Industrial Average closed down 2.82% to 33,811.4, the S&P 500 index fell 2.77% to 4,271.78 and the Nasdaq Composite index fell 2.55% to 12,839.29.

With this position, for this week the Dow Jones fell 1.9%, the S & P fell 2.8%, and the Nasdaq fell 3.8%.

It was the third straight week of losses for the S&P 500 and Nasdaq, while the Dow Jones posted its fourth straight weekly decline.

For the Dow, the 2.82% drop in trade this time was the biggest one-day drop since October 2020.

Excessive trading fluctuations have become more common in recent days, as market participants adjust to new data from performance, as well as when prices may rise again. For the Nasdaq, this is the eighth session in April, out of 15 trading days this month, in which the index is up or down more than 2%.

"It's not uncommon, as long as I've been doing this work, for the market to move 2% in either direction and think 'not too much to read that'," said Craig Erlam, senior market analyst at OANDA.

"That's not normal, but that's how it has been for a long time now."

Worries about the risks from a rate hike continue to resonate after the hawkish pivot from Federal Reserve Chair Jerome Powell on Thursday. At the time, Powell supported plans to fight inflation more quickly and said a 50 basis point hike would be "on the table" when the Fed meets in May.

The US central bank's "front-end loading" idea of super-loose monetary policy, backed by Powell on Thursday, has also forced market participants to re-evaluate how aggressive the next rate hike will be.

The CBOE Volatility Index, also known as Wall Street's fear gauge, surged on Friday, ending at its highest level since mid-March.

Meanwhile, the latest earnings forecasts that surprised investors came from healthcare, with HCA Healthcare and Intuitive Surgical Inc the worst-performing issuers in the S&P 500.

In which, HCA shares slumped 21.8% after reporting a dismal profit outlook, while other hospital operators felt the contagion: Tenet Healthcare, Community Health Systems and Universal Health Services fell between 14% and 17.9%.

Robotic surgery maker Intuitive Surgical also lost 14.3% after warnings of weak demand from hospitals due to tighter finances.

All 11 major S&P 500 sectors fell, although the 3.6% decline by healthcare was eclipsed by the materials sector, which fell 3.7%.

The sector was weighed down by shares of Nucor Corp which lost 8.3% after hitting a record high after reporting performance on Thursday (21/4). Freeport-McMoRan Inc, also slid 6.8% as investors worried about how a rate hike would impact copper miners.

The prospect of a more hawkish Fed rate hike has led to a rocky start to the year for the equities sector, with Friday's sell-off taking the declines in the S&P and Dow since the start of the year beyond 10%.

This trend is more pronounced in technology and growth stocks whose valuations are more susceptible to rising bond yields. The Nasdaq is down 17.9% in 2022.

Performance reports from the four largest US companies by market capitalization: Apple, Microsoft, Amazon and Google parent Alphabet are due out next week.

Shares of the four companies fell between 2.4% and 4.1% on Friday. Meta Platforms Inc, which also has a financial report for the week ahead, lost 2.1%, leaving it already down 15.3% in the past three days.

Investors were worried after streaming giant Netflix Inc's performance was disappointing earlier this week. That sent shockwaves through major tech stocks and companies that benefited while people were staying at home due to the pandemic.

Follow Daily Post on Google News to update information quickly. Thank you for visiting our website..!! Don't forget to share any information to help develop our website..