Managing finances is a very important thing to do for a comfortable life in the future. Unfortunately, there are still people who cannot commit to saving and are wasteful, so the salary money earned at the beginning of the month runs out in the blink of an eye in the middle of the month.

.

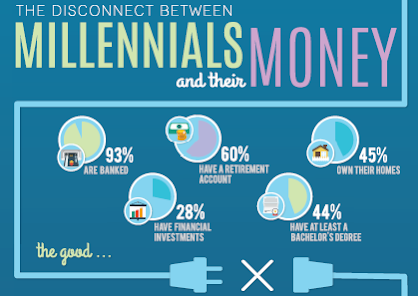

Currently, many millennials are adopting a consumptive socialite lifestyle, such as hanging out in fancy cafes, shopping online, traveling abroad, and doing other entertainment activities. Millennials are considered unable to contain their high shopping appetite, so that their cash inflow and savings do not increase. Maybe you are one of them.

Tips for Managing Finances to Achieve Financial Pretensions

Making good financial planning is needed to be financially free in old age when you retire. Saving is not an easy thing to do. It takes a high and consistent commitment so that you can achieve the fiscal thing you want. Some tips for managing finances that you can apply include:

.

Allocate Savings Funds in a Special Account

Currently, saving is very easy with the presence of a digital bank that allows you to create multiple savings accounts in one account. In addition, some digital bank applications also allow you to track your monthly cash inflow so you know your money in and out in more detail

For example, you need to save for continuing education costs, save to buy a house, and retirement insurance. These three savings can be opened in one digital bank account without having to open multiple bank accounts which might be more troublesome. Saving as needed will make it easier for you to track how much savings you have accumulated.

If the need for several posts is combined into one savings, it is difficult for you to determine which savings have reached the target and which have not. While learning to allocate funds by opening a special savings account, you also need to complete your knowledge of how to manage finances.

Find Extra Income

Day by day, the cost of living is getting more expensive. Sometimes the monthly income is only enough for basic needs and not left for saving. So the solution to overcome this, you need to find additional income so that you can fill your savings.

You can do some side work such as selling online, becoming a reseller of an item or being a freelancer. You can also take advantage of the skills you have, such as graphic design skills to accept social media content creation, have the ability to write and become a content pen, and so on.

Reduce Installment Items

In today's digital era, buying goods in installments is very easy. No need for a credit card, you can buy what you want on credit. The interest offered is sometimes low, but many credit institutions offer very high interest rates.

To be able to manage finances and have some savings for the future, avoid making purchases on credit. Buy the item you want with cash. Save first until your money is collected to buy the item. With this, you can reduce the list of debts and can use interest payments to increase your savings.

Also identify some of the wrong behaviors in managing money so that you run out of money more often instead of having a lot of money to save. Some of them.

Dare to Invest

Currently, investment is increasingly being campaigned as a way to prepare a number of funds for a better life in the future. Investments also vary, from investing in stocks, mutual funds, money markets, to investing in gold. Dare to invest is the right step you can take to discipline your finances.

Choose investments that you understand to avoid fraud and losses in investing. For example, if you are not familiar with stock investing, then you can try money market investments which also provide the best dividends every month. Also choose a credible and trusted investment platform.

Financial planning is very important to determine the budget

Create a Financial Plan

Financial planning is very important to determine the budget that you will spend. You can make daily, monthly, and yearly budgets. For example, how much money will you spend on basic necessities each month. Then, you can include electricity bills, water bills, and so on in your monthly plan.

If you want to buy certain items that are a bit expensive, you can create an annual spending plan. For example, you want to buy a laptop, set aside your money every month for a certain period of time to buy the laptop you want.

You can target what month you will buy the laptop in, whether it is the beginning of the year, the middle of the year or even the end of the year. This annual budget is also very helpful for you to save money throughout the year because every month you already have a target to achieve.

Check Balance Periodically

Another tip for managing finances for millennials is to check the balance in your main account regularly. This is important so that you don't use it to shop more. Try to keep the balance in your account, don't leave it empty.

Managing finances for the millennial generation is indeed a challenge that must be overcome. The high lifestyle and the desire to shop make financial arrangements a mess. However, like it or not, saving is an important thing that must be done to be financially free in old age. Therefore, millennials must discipline themselves to manage finances so they can live comfortably in the future.